Delete Debt

This option allows for the permanent removal of an existing debt for a debtor. If a debt shouldn't have been entered for the debtor this is the method for removing. In addition, when debtors make payments directly to your office and you want to remove them to ensure it will not be setoff, this is how it is done.

Reminder: a debt may still be setoff after deletion if the debtor files a state tax refund or submits a winning lottery ticket of $600 or more within several weeks. We suggest waiting until mid-December after the last setoff file of the year and let the Tools-Delete $0.00 debts option remove these debts.

Reminder: a debt may still be setoff after deletion if the debtor files a state tax refund or submits a winning lottery ticket of $600 or more within several weeks. We suggest waiting until mid-December after the last setoff file of the year and let the Tools-Delete $0.00 debts option remove these debts.

If a debt has been deleted from a Delete Debtor or Delete Debts and the debt was setoff, it will appear on the Error page of the Transmit-Import from Clearinghouse-Setoffs process. The debt amount setoff was deposited into your Capital Management account . To make the setoff file balance and record in Setoff History, the debt must be re-added and then the Clearinghouse will have to modify the Unique Key to match the debt that was just re-added.

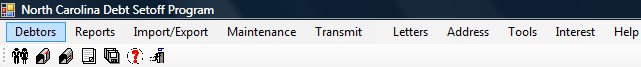

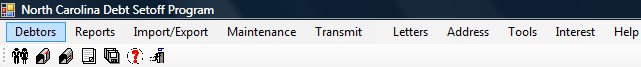

1. From the Main Menu click Debtors:

2.The Debtors menu option:

The Debtor menu option is also available on the Icon Toolbar:

- Add/edit Debtor Information

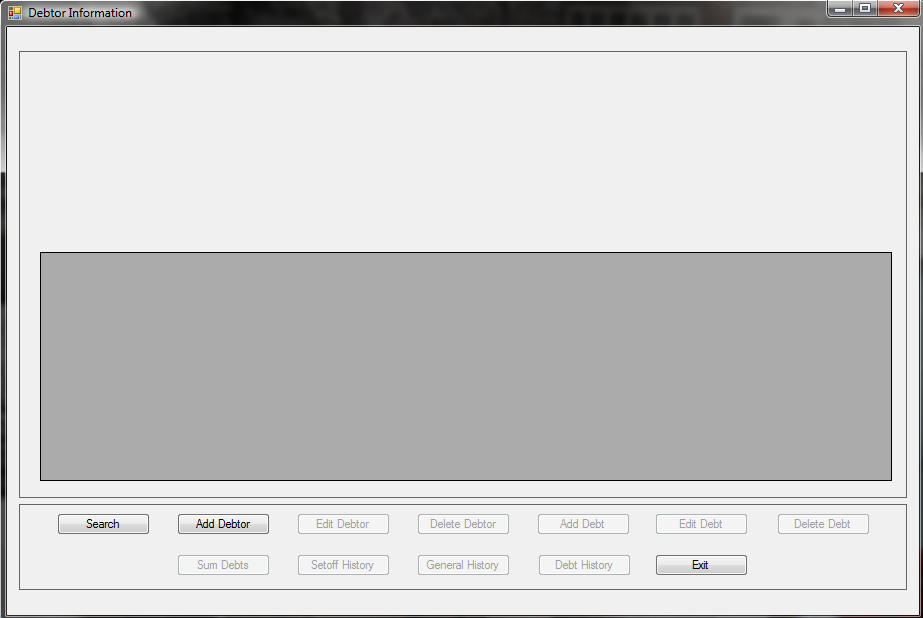

3. A blank entry screen appears:

4. Search for the Debtor See "Search Debtors"

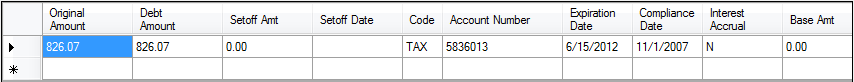

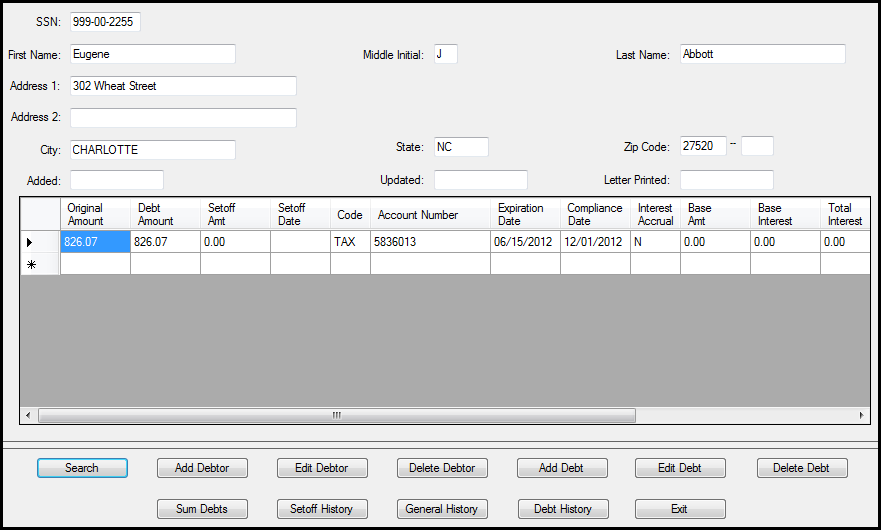

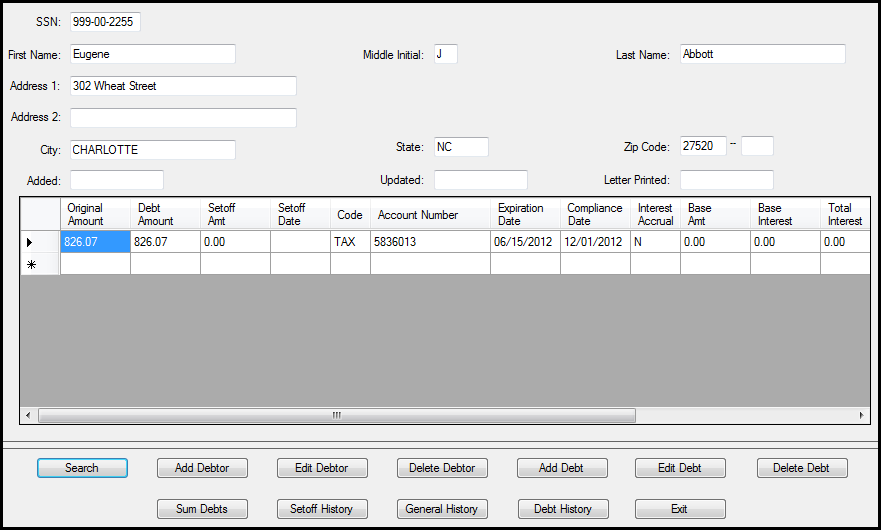

5. When the debtor appears, such as the following:

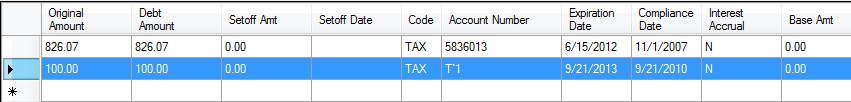

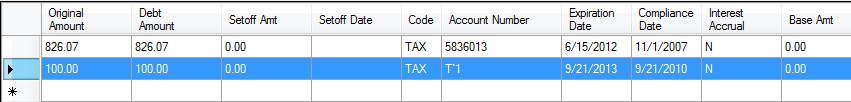

5. When there a multiple debts be sure to click the desired debt to remove. An example of selecting the second debt:

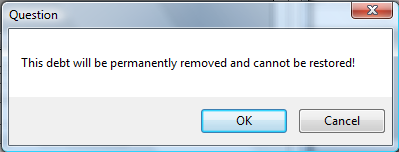

6. Click  for the following screen:

for the following screen:

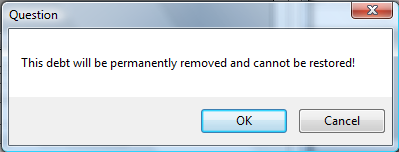

7. Click  to delete the debt or click

to delete the debt or click  to abort without deleting

to abort without deleting

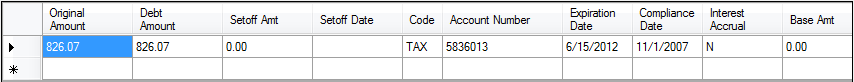

8. The results from the deletion of the second debt:

Reminder: a debt may still be setoff after deletion if the debtor files a state tax refund or submits a winning lottery ticket of $600 or more within several weeks. We suggest waiting until mid-December after the last setoff file of the year and let the Tools-Delete $0.00 debts option remove these debts.

Reminder: a debt may still be setoff after deletion if the debtor files a state tax refund or submits a winning lottery ticket of $600 or more within several weeks. We suggest waiting until mid-December after the last setoff file of the year and let the Tools-Delete $0.00 debts option remove these debts.

for the following screen:

for the following screen:

to delete the debt or click

to delete the debt or click  to abort without deleting

to abort without deleting